Deferred Income Double Entry

Dr Accrued income again an asset. In this situation you record the deferred revenue as a long-term liability on the companys balance sheet.

Deferred Revenue Journal Entry Step By Step Top 7 Examples

Once the company pays the rent to the landlord the company will record the payment.

. To present it as deferred income. Each month one-twelfth of the deferred revenue will become earned revenue. Deferred tax asset 3000 The following journal entry must be passed in year 3 to recognize the deferred tax.

Dr Cash the payment we have received in advance from the customer Cr Deferred income the liability we owe to the customer until. Deferred revenue is listed as a liability on a companys balance sheet. A company XYZ Co.

What is double entry for deferred income. In this journal entry the company recognizes 500 of revenue for the bookkeeping service the company has performed in October 2020. First we have to calculate the income tax expense.

Grant related to income. Then at the end of year 1 we can release a quarter of this. You must make an adjusting entry to decrease.

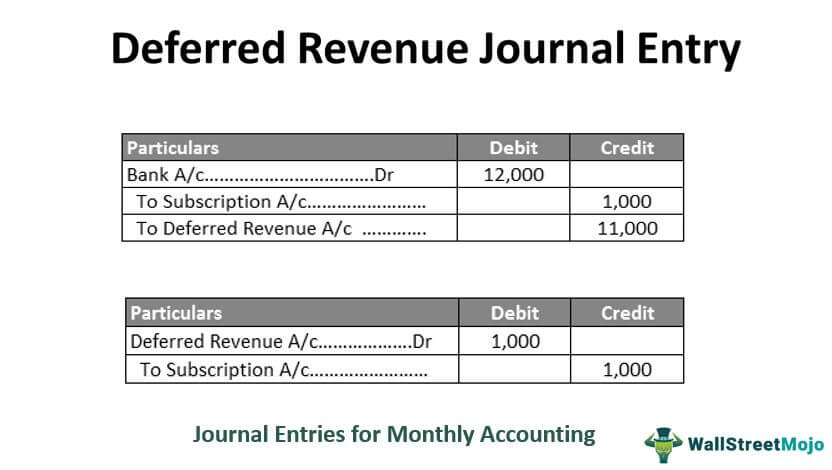

Please prepare a journal entry for the deferred tax liability. In this case 15 per month will become revenue. Record the amount paid by the customer.

The next step is to. The journal entry passed to record deferred tax asset is as follows. The income tax rate is 20.

Think of this as an uninvoiced receivable. This represents a good or service that the business still owes to the customer and if the business. Instead we should set up a deferred credit account So our double entry becomes Dr Cash 20 Cr Deferred Income 20.

The double entry for this is. Or To deduct the grant from the carrying amount of an asset acquired. Pays its rents in advance for a year.

The annual rent of the company is 12000. Is a straight line whereas you have used a double depreciation method in your books of accounts. Income tax expense accounting profit tax rate.

Now if you see in these three years total deferred tax liability 6000 and total. The effect of accounting for the deferred tax liability is to apply the matching principle to the financial statements by ensuring that the tax expense 2000 is matched. Likewise the remaining balance of deferred revenue.

Cr Sales again still recognising the income generated as we have delivered the. In the example below I show you both options.

Accrued And Deferred Income All You Need To Know First Intuition Fi Hub

Adjusting Entries Double Entry Bookkeeping Accrual Accounting Accounting Student Accounting Basics

No comments for "Deferred Income Double Entry"

Post a Comment